Can you open a checking account in Thailand? You’re about to embark on an thrilling journey that will make your life easier, and assist you to decrease your bills.

Nonetheless sooner than you get started, there’s one issue you must know: it could be a bit troublesome at events!

Ready To Journey? Don’t Go With out Journey Insurance coverage protection.

I prefer to advocate SafetyWing Nomad Insurance coverage protectionan fairly priced journey insurance coverage protection offering computerized month-to-month funds which you’ll be able to cancel anytime. I’ve been using it since 2019, and I can assure you it’s the proper decision for nomads equivalent to you and me. Research additional by finding out our SafetyWing overview.

From paperwork requirements to language boundaries to cultural variations, opening up a checking account in Thailand isn’t always simple.

Nonetheless don’t concern — we’ve acquired all the rules and ideas you need so that navigating this course of is as easy as potential.

Sooner than we get started, you must phrase that I opened a checking account in Chiang Mai, so that you may face some minor variations whenever you open a checking account someplace else in Thailand.

On this data, we’ll cowl all points related to banking in Thailand.

So buckle up and put together to review one of the simplest ways to open a checking account in Thailand!

Best Banks In Thailand For Foreigners

Within the occasion you identify to open a checking account in Thailand, you is perhaps questioning which monetary establishment is best for foreigners.

Planning your upcoming adventures? Journey by bus! (It’s low price!)

After we requested companies, we had been knowledgeable Bangkok Monetary establishment and Kasikorn Monetary establishment had been the perfect selections for foreigners.

After a quick search in Fb groups for expats in Thailand, it appeared that Bangkok Monetary establishment was the perfect monetary establishment for foreigners, so we decided to go for Bangkok Monetary establishment.

Now, you must know that there are quite a few others banks in Thailand to consider, nonetheless it’s not always easy to open a checking account abroad, so we thought it’d be greater to pick a simple and fast alternative.

Course of Of Opening A Monetary establishment Account In Thailand

Opening a checking account in Thailand is easy as long as you have gotten all the suitable paperwork. Let’s try the paperwork wished first.

Paperwork Required By The Monetary establishment

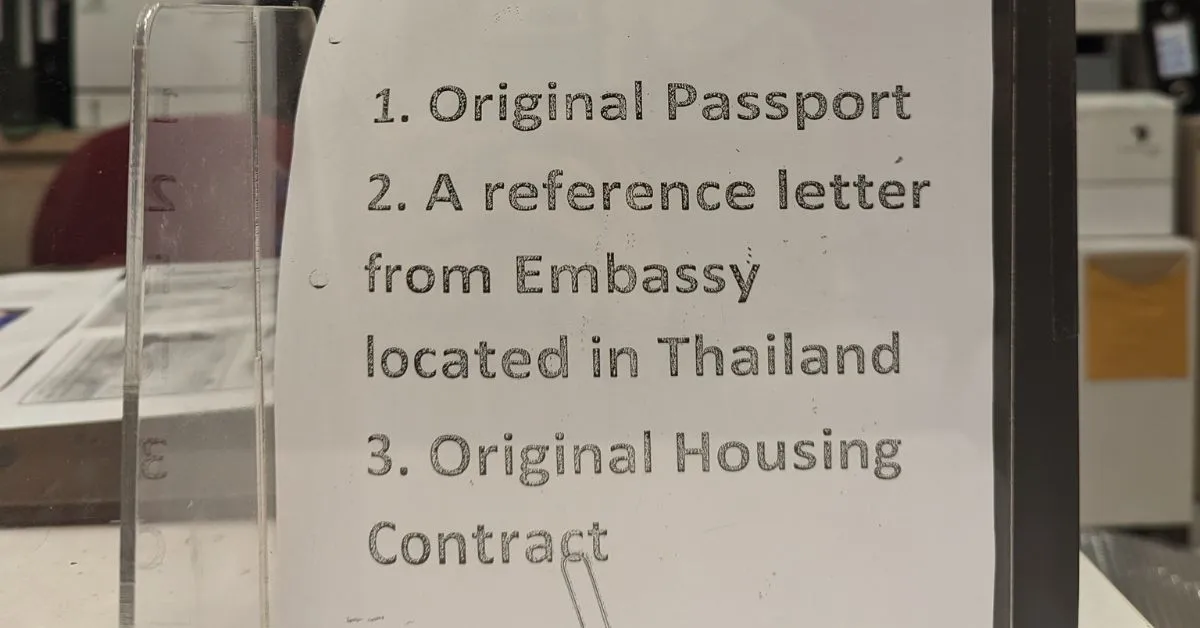

To open a checking account, you’ll need the subsequent paperwork:

You don’t should convey copies of your passport or your lease, as a result of the monetary establishment officer might make copies instantly on the monetary establishment. Nonetheless, it’s very important to note that the officer will take the distinctive residence certificates.

Be mindful to convey money with you, as you’ll should make a deposit and pay a small worth to get a monetary establishment card.

Course of

- Select a monetary establishment shut by, and when you get there, you may wish to choose a queue amount to open a checking account. Guarantee you have got all of the becoming paperwork with you (see the document above).

- When your amount is known as, go to the office and request to open a checking account. The officer will ask to your paperwork and give you paperwork to fill out.

- The officer will ask you which ones types of banking corporations you’ll need. We requested for a debit card and entry to a mobile banking app.

- Pay the worth to open the checking account (worth, card, insurance coverage protection, and deposit).

- Sign quite a lot of paperwork.

- Resolve on a beneficiary.

- Organize your PIN for the mobile banking app, and for the monetary establishment card.

- And there you have gotten it. You now have a Thai checking account.

Now, it’s necessary to know that opening a checking account shall be prolonged, so convey your best self and endurance alongside.

Protect finding out to seek out out about my experience opening a checking account in Chiang Mai, Thailand.

My Experience Opening A Monetary establishment Account In Chiang Mai

My confederate and I decided to open a checking account at Bangkok Monetary establishment in Central Competitors in Chiang Mai.

On our first strive, we wanted to attend one hour for our amount to get known as, after which, the officer disapproved of our lease settlement as there was an online web page that the proprietor didn’t sign.

The following day, we obtained right here once more with an correct copy of the lease. We would have liked to attend one different hour for our amount to get known as.

As I was there with my confederate, we wanted to open two Thai monetary establishment accounts, and all the course of took spherical 1h30. In the long term, we had been on the monetary establishment for pretty a while.

After we left, we already had entry to the mobile banking app, a monetary establishment card, and money in our checking account.

We every wanted to pay THB 1,800. This worth consists of insurance coverage protection for one yr and a monetary establishment card.

The following day, I transferred money to my Thai checking account with Wiseand it labored instantly.

On-line Banking In Thailand

Each monetary establishment has its private on-line banking app, nonetheless most are comparable.

Alongside along with your app, you’ll:

- Swap money to completely different monetary establishment accounts in Thailand.

- Pay funds.

- Scan QR codes.

- Withdraw money in ATMs.

- And lots of others.

ATMs In Thailand

You’ll uncover ATMs all through Thailand, and also you may use them to:

- Withdraw money out of your Thai checking account.

- Withdraw cash out of your journey card. As an illustration, you’ll withdraw money with Revolut in Thailand.

- Take a look at your stability.

- Change your PIN code.

- And lots of others.

Be taught our data to review additional about money in Thailand.

Banking Alternate choices For Foreigners In Thailand

Together with banks, there are completely different banking choices for foreigners in Thailand.

Listed beneath are one other strategies you’re going to get, withdraw or swap money in Thailand:

- Wise – A fast and protected approach to change money from one foreign exchange to a distinct. As an illustration, I benefit from Wise to change money to my Thai checking account.

- MoneyGram – One different protected service meaning which you could ship money in minutes.

- PayPal – You may use PayPal to acquire money from abroad and to ship funds.

- Revolut – You possibly can even open a Revolut account and use it in Thailand. It’s good for touring abroad, as you’ll entry a variety of currencies and extra perks. Research additional regarding the Revolut journey card.

Final Concepts About Opening A Monetary establishment Account In Thailand

Opening a checking account in Thailand can stop a spread of time and money. With an account, you’ll have entry to additional banking corporations, and likewise you’ll have the power to change, withdraw and procure money with ease.

For a simple experience, be sure you have all the paperwork you need with you when visiting the monetary establishment.

It’s moreover very important to know the costs associated to opening an account and any corporations you may want. So, be sure you convey money too.

Touring to Thailand rapidly? Be taught considered one of many following guides:

Leave a Reply